Global Textile Chemicals Market Size in 2020

Affected by Covid-19, the growth of the textile chemicals market in 2020 has been significantly affected. Therefore, the market is expected to grow at a lower CAGR this year.

Textile chemicals refer to the necessary raw materials in the dyeing and processing of textiles. These chemicals enable textiles to achieve desired properties such as color and mechanical strength. Textile chemicals include bleaches, colorants, surfactants, finishes, sizing agents, and yarn lubricants, among others. During the weaving process of yarns, these yarns are used at various stages to provide strength and attractive features to garments or textiles.

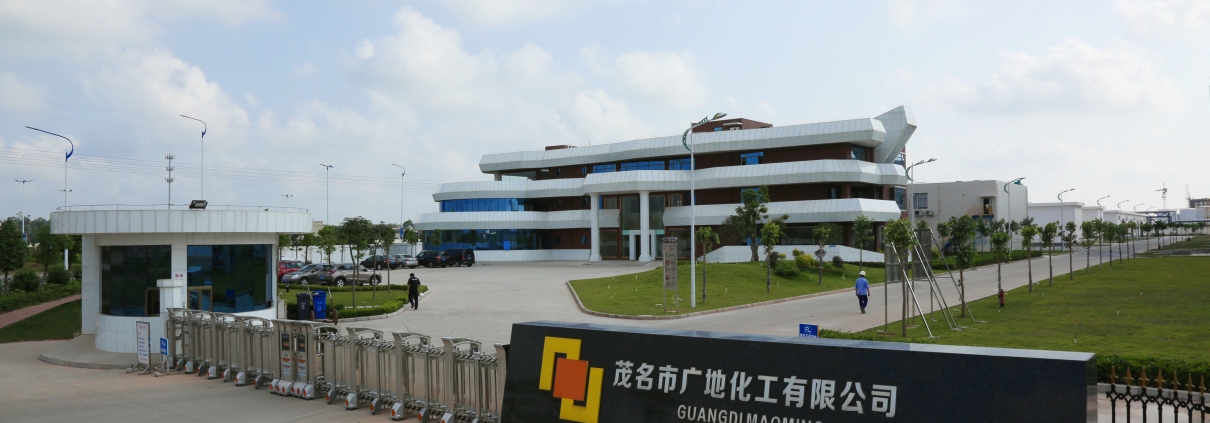

Major factors driving the growth of the textile chemicals market include the growing global demand for apparel and industrial fabrics. Apparel is often a highly valued industry for countries engaged in export-oriented markets, where fixed costs are relatively low. Rapid growth in the apparel industry has significantly propelled the growth of the textile chemicals market. In addition, the paradigm shift in sustainable and responsible manufacturing is upending the market trend of textile chemical types. Currently, green textile chemicals are the most popular chemicals on the market. In addition, non-toxic, environmentally friendly dyes and colorants are becoming more and more popular. Guangdi Chemical Co., Ltd. is one of the largest sodium hydrosulfite, sodium sulfite, and sodium metabisulfite manufacturers in China, located in the Maoming National Hi-Tech Industrial Development Zone in Guangdong. Guangdi’s business covers the production, storage, transportation, sales, and service of chemical products. The ECO Passport and ZDHC Certificate assure the top product quality of Guangdi products.

The Asia Pacific dominated the global textile chemicals market share in 2020. Low production and labor costs supported by new technologies have led to rapid growth in the region. China is the world’s largest producer and consumer of textile chemicals, and most of its products are exported to North America and Europe. Apart from this, East Asian countries such as India, Bangladesh, Vietnam, and Indonesia are some of the other major textile producers in the Asian region. For example, Bangladesh’s garment and apparel export business has roughly tripled between 2008 and 2018. In addition, the textile industry contributes about 13% to the country’s GDP.

Growth and Forecast for Global Textile Chemicals Market

According to the latest analysis of Emergen Research, the global textile chemicals market will reach USD 21.23 billion in 2020, with a compound annual growth rate of revenue of 4.3% during the forecast period. The growing demand for global textiles is one of the key factors that continue to drive the growth of the global textile chemicals market. In addition, the global urbanization and industrialization growth trend is expected to continue to support the revenue growth of the textile chemicals market for at least the next five years.

Guangdi Chemical Co., Ltd. is one of the largest sodium hydrosulfite, sodium sulfite, and sodium metabisulfite manufacturers in China, located in the Maoming National Hi-Tech Industrial Development Zone in Guangdong. Guangdi’s business covers the production, storage, transportation, sales, and service of chemical products. The ECO Passport and ZDHC Certificate assure the top product quality of Guangdi products.

In the report, technical textile segment revenue is expected to boost at a significantly rapid CAGR during the forecast period due to the increasing usage of textile chemicals in technical textiles. Usage is expected to rise due to rising awareness about better function and uses of such products in various industries.

The revenue growth rate in the Asia-Pacific region is expected to accelerate significantly during the forecast period. Countries in the Asia-Pacific region have low manufacturing costs and many companies are actively introducing cutting-edge technologies, which are expected to drive revenue growth in the region’s market in the next few years.

Impact of COVID-19 on the Sodium Hydrosulfite Market

During the COVID-19 epidemic, the global Sodium Hydrosulfite market is estimated to be USD 1.2 billion in 2020 and is expected to reach USD 1.4 billion by 2027, with a compound annual growth rate of 2.4%.

Wood pulp bleaching is one of the main uses of Sodium Hydrosulfite. Taking into account the business impact of the COVID-19 epidemic and the economic crisis caused by it, it is estimated that by 2027, the wood pulp bleaching market will reach 536.4 million U.S. dollars, with a compound annual growth rate of 3.1 %. The growth of the textile industry was adjusted to a compound annual growth rate of 2.2%.

Guangdi Chemical Co., Ltd. is the largest sodium hydrosulfite(sodium dithionite) manufacturer in China, located in the Maoming National Hi-Tech Industrial Development Zone in Guangdong. Guangdi’s business covers the production, storage, transportation, sales, and service of chemical products. The ECO Passport and ZDHC Certificate assure the top product quality of Guangdi products.

In 2020, the US Sodium Hydrosulfite market is estimated to be USD 320.4 million. As the second-largest economy in the world, China is expected to have a market size of 280.7 million U.S. dollars by 2027, with a compound annual growth rate of 4.7%. Other notable regional markets include Japan and Canada. Between 2020 and 2027, the sodium dithionite market is expected to grow by 0.5% and 1.8% in this region, respectively. In Europe, Germany is expected to grow at a compound annual growth rate of approximately 1.1%.

Regarding the Mineral Ore Flotation industry, the United States, Canada, Japan, China, and Europe will drive the expected 1.5% compound annual growth rate in this field. The total market size of these regional markets in 2020 is 44.5 million U.S. dollars and is expected to reach 49.5 million U.S. dollars in 2027. China will remain one of the fastest-growing countries in this regional market cluster. Latin America will grow at a compound annual growth rate of 2.6% throughout the analysis period.

Global Specialty Pulp & Paper Chemical Market to be Expected CAGR of 5.6%

The global specialty pulp and paper chemicals market was valued at 15.57 billion in 2016 and is expected to reach 22.82 billion by 2023, with a compound annual growth rate of 5.6% from 2017 to 2023.

Specialty pulp and paper chemicals are the raw materials used to produce specialty paper. These are the integral part of the manufacturing process of paper and reduce the consumption of water and energy. It also improves the optical and functional properties of paper such as color, texture, brightness, strength, printing ability, and others during the paper manufacturing process. Some of the specialty paper chemicals include sodium hydrosulfite, hydrogen peroxide, and chlorine, which are used as bleaching agents; sodium silicate, enzymes, and various surfactants used in the de-inking process; and alkyl ketene dimer and alkenyl succinic anhydride used for sizing.

Guangdi Chemical Co., Ltd. is the largest sodium hydrosulfite(sodium dithionite) manufacturer in China, located in the Maoming National Hi-Tech Industrial Development Zone in Guangdong. Guangdi’s business covers the production, storage, transportation, sales, and service of chemical products. The ECO Passport and ZDHC Certificate assure the top product quality of Guangdi products.

Sodium Hydrosulfite(SHS) is also known as Hydrosulphite Concentrate or Sodium Dithionite or Sodium Hydrosulphite (Na2S2O4). It is a white or grayish-white powder, free from visible foreign particles with a pungent odor. It is classifiable under the custom codes 28311010 and 28321020.

Specialty pulp and papermaking chemicals are the raw materials used to produce specialty paper. These are integral parts of the paper manufacturing process and can reduce water and energy consumption. It can also improve the optical and functional properties of paper during the paper manufacturing process, such as color, texture, brightness, strength, printing ability, etc. Some specialty paper chemicals include sodium hydrosulfite, hydrogen peroxide, and chlorine, which are used as bleaching agents; sodium silicate, enzymes, and various surfactants used in the deinking process; alkyl ketene dimers used for sizing Body and alkenyl succinic anhydride.

In the past decade, paper recycling has become very important in the global paper industry. The increase in the use of recycled paper has led to an increase in demand for specialty pulps and papermaking chemicals. In addition, the increasing demand for functional chemicals in various applications such as packaging, printing, and decoration has boosted the specialty pulp and paper chemicals market.

The functional chemicals part of specialty chemicals includes different types of dry strength additives, wet strength resins, optical brighteners, and sizing agents. The wide application of specialty paper in different fields requires paper to have different characteristics in terms of color, brightness, sizing, and texture. The use of functional chemicals has increased to meet the needs of the paper industry, which has contributed to the growth of the specialty pulp and paper chemicals market.

Market Research on Sodium Metabisulfite Industry in China 2018-2023

The demand for sodium metabisulfite has maintained steady growth in recent years. The output has increased from about 70 tons in 2011 to about 890 tons in 2017, and the compound annual growth rate from 2011 to 2017 is about 4%. In 2017, the market size was 1.9 billion yuan, an increase of 4.5%.

Guangdi Chemical Co., Ltd. Is one of the largest manufacturers of sodium metabisulfite, sodium hydrosulfite, and sodium sulfite in China, located in the Maoming National Hi-Tech Industrial Development Zone in Guangdong. Our business covers the production, storage, transportation, sales, and service of chemical products. We have ECO Passport and ZDHC Certificate that assure the top product quality.

Sodium metabisulfite or sodium pyrosulfite (IUPAC spelling; Br. E. sodium metabisulphite or sodium pyrosulfite) is an inorganic compound of the chemical formula Na2S2O5. The substance is sometimes referred to as disodium metabisulfite. It is used as a disinfectant, antioxidant, and preservative agent.

In terms of downstream demand, industrial-grade sodium metabisulfite consumes the largest amount, followed by medical-grade sodium metabisulfite. 40% of industrial grade sodium metabisulfite is used in the production of sodium dithionite.

The main raw materials for the production of sodium metabisulfite are soda ash and sulfur. In China, there are many manufacturers of these two raw materials, which provide sufficient supply for the production of sodium metabisulfite.

The sodium metabisulfite industry is closely related to other industries in the national economy, thus pushing the industry forward. As the downstream demand of the industry continues to increase, the market for sodium metabisulfite has a very broad room for growth. In the next few years, with the rapid development of downstream industries, the sales scale of sodium metabisulfite is expected to rise steadily, approaching 2.3 billion yuan.

Increase Trend for Sodium Hydrosulfite Market

Sodium Hydrosulfite’s global market size is expected to grow by a CAGR of about 4% in the next few years.

Guangdi Chemical Co., Ltd. is the largest sodium hydrosulfite(sodium dithionite) manufacturer in China. Our factory is located in Maoming, Guangdong Province. Our business covers the production, storage, transportation, sales, and service of chemical products. We have ECO Passport and ZDHC Certificate that assure the top product quality. If you need to import Sodium Hydrosulfite, please feel free to contact us.

Sodium Hydrosulfite(SHS) is also known as Hydrosulphite Concentrate or Sodium Dithionite or Sodium Hydrosulphite (Na2S2O4). It is a white or grayish-white powder, free from visible foreign particles with a pungent odor. It is classifiable under the custom codes 28311010 and 28321020.

Sodium Hydrosulfite is extensively used in many fields, such as textile and paper industries. The demand for sodium hydrosulfite as a reducing agent in the synthesis of kaolin and metakaolin has been rising rapidly, which will provide new growth opportunities for the sodium hydrosulfite market. It is used to improve the brightness of kaolin and is used in the manufacture of paper, ceramics, paints and coatings, glass fibers, plastics, rubber, and cement.

In the paper manufacturing process, sodium hydrosulfite is commonly used as a reductive bleaching agent for pulp. Most of the demand for paper products comes from the packaging industry, which has been booming since the past decade. Easily available raw materials, low labor costs, and the presence of many paper and pulp manufacturers will promote the development of the paper products industry in the Asia-Pacific region, which will also further promote the development of the global sodium hydrosulfite market.

The gradual decline in North American and Western European paper and cardboard production capacity may have a negative impact on the growth of the global sodium hydrosulfite market. The main reason for the decline in production capacity is the increasing level of digitization in the region, which has led to a decrease in the demand for paper and paper products. In 2016, North American paper and paperboard production capacity were 79.6 million tons, and by 2024 it may drop to about 70 million tons. Meanwhile, In 2016, Western European paper and paperboard production capacity exceeded 88.2 million tons and is expected to drop to less than 80 million tons in 2024.